05:57

UK: Russia heading for deepest recession since Soviet Union collapsed

Russia is heading for its deepest recession since the collapse of the Soviet Union, the UK government has predicted.

Economists expect Russia’s GDP this year to contract by between 8.5% and 15%, the UK says, as it announces sanctions on Vladimir Putin’s two adult daughters.

GDP growth is likely to be depressed over the longer term, as Russia is cut off from Western technology, it adds.

Around £275bn, or 60% of Russian foreign currency reserves, are currently frozen, the UK estimates, which has hampered Moscow’s ability to support its economy.

Foreign Secretary Liz Truss said:

Our unprecedented package of sanctions is hitting the elite and their families, while degrading the Russian economy on a scale Russia hasn’t seen since the fall of the Soviet Union.

But we need to do more. Through the G7, we are working with partners to end the use of Russian energy and further hit Putin’s ability to fund his illegal and unjustified invasion of Ukraine.

Together, we are tightening the ratchet on Russia’s war machine, cutting off Putin’s sources of cash.

Last month the Institute of International Finance forecast that Russia’s economy would shrink by 15% this year, and that any further boycotts of Russian energy would drastically impair its ability to import goods and services.

Those recession concerns prompted Russia’s central bank to cut interest rates from 20% to 17% this morning.

#Russia delivers surprise rate cut by 300bps from 20% to 17% amid recession, Ruble rebound. Financial-stability risk no longer rising, Bank of Russia says. Central bank says further cuts could come at future meetings. Ruble stays below 80 per Dollar. pic.twitter.com/olaQr7FMrh

— Holger Zschaepitz (@Schuldensuehner) April 8, 2022

The foreign currency freeze stopped Russia paying holders of its sovereign debt more than $600m earlier this week. The US Treasury blocked Russia’s ability to make debt payments in dollars through American banks, meaning Moscow had to set aside roubles instead. That could count as a debt default, after a 30-day grace period.

Updated at 06.03 EDT

6m ago12:14

Russian inflation accelerated to two-decade high in March

Just in: inflation in Russia accelerated last month as the plunge in the rouble drove up import costs and sanctions hit the economy.

Data just released shows that Russian consumer prices jumped by 7.61% in March alone, the fastest monthly increase in inflation since 1999.

The annual CPI index rose by 16.69% in March, sharply up on February’s 9.15%.

Reuters has more details:

In March, sugar prices jumped 44% compared with February, while prices for onions and washing machines rose 50% and 46%, respectively.

#BREAKING Inflation in Russia hit 16.7% in March year on year, according to data from the statistics agency Rosstat.

— CGTN Europe (@CGTNEurope) April 8, 2022

35m ago11:45

FTSE 100 closes at eight-week high

In the City, the UK’s blue-chip stock index has closed at its highest level in two months, as European markets shrug off concerns over slowing growth and the ongoing Ukraine war.

The FTSE 100 has jumped 1.5% today, or 118 points, to end at 7,670 points.

Miners and oil companies were in the top risers, such as Anglo American (+4.8%), Shell (+3.9%) and BP (+3.7%). Banks and retailers also rallied.

Stocks were up across Europe too, despite concerns that the cost of living crisis will slow the recovery. Germany’s DAX gained around 1.4%, while France’s CAC index was 1.3% higher ahead of the first-round vote in France’s presidential election this weekend.

David Madden, market analyst at Equiti Capital, wrote:

Stock markets are on track to finish higher this afternoon as traders have shrugged off the negative headlines about additional sanctions on Russia, as well as the chatter about higher interest rates from the Federal Reserve.

By and large, it was a negative week for equities as countries revealed plans to target Russia’s energy exports. Earlier today, Japan announced that it will ban the importation of coal from Russia – the EU made a similar announcement during the week. Dealers are getting used to the idea of even higher interest rates from the Fed as US central bankers are open to hiking rates by 50 basis points in a bid to tackle rising inflation.

Updated at 11.51 EDT

1h ago11:19

Russia’s central bank’s interest rate cut at an unscheduled meeting of policy makers today is a sign that efforts to stabilize the country’s financial system are having an effect, says the WSJ:

In a statement announcing the reduction in the key rate to 17% from 20%, the Bank of Russia said the ruble’s rebound from sharp losses in the days immediately following the Feb. 24 invasion had reduced the risk that inflation would move sharply higher.

Russia’s central bank reduced its key rate to 17% from 20%, a slight stepping back from the emergency measures taken in response to punishing Western sanctions https://t.co/1Sz0uy5Enq

— WSJ Central Banks (@WSJCentralBanks) April 8, 2022

1h ago10:51

The costs of insuring merchant ships sailing to ports in the Black Sea has spiraled out of control, Bloomberg reports this afternoon.

This is becoming a huge potential impediment to the movement of Russian cargoes from the region, adding to the pressures on its economy.

Here are the details:

Underwriters are charging as much as 10% of the value of a ship’s hull — basically the vessel’s worth as an asset — for what is called additional war-risk premium, according to four people involved in the market.

Some are simply quoting to cover at prices that they know will be refused. There was almost zero cost prior to the war.

It means that insurance now likely exceeds the cost of hiring the vessel itself. A $50m, five-year old tanker hauling a standard 1 million-barrel Russian cargo would need $5m just in insurance premiums — about $1.5m above the cost of hiring the carrier.

The cost of insuring a ship going into the Black Sea is spiraling out of control as war risks mount (including drifting mines). Hiring a Suezmax (1m barrels) from the Black Sea to Italy costs about $3.5 million — but the insurance adds another $5 millionhttps://t.co/lp9zcJnZEb

— Javier Blas (@JavierBlas) April 8, 2022

2h ago10:31

While Russia is cutting interest rates, Sri Lanka has doubled them as the economic meltdown gripping the country continued.

The Central Bank of Sri Lanka’s (CBSL) monetary board raised its standing lending facility to 14.50% and its standing deposit facility to 13.50%, both up 700 basis points.

It acted to try to tackle inflation, with prices having soared due to crippling shortages of basic goods driven by a devastating economic crisis.

Earlier this week, the Sri Lankan rupee plunged to become the world’s worst-performing currency, while its sovereign dollar bonds are trade at deeply distressed levels.

There have been warnings that Sri Lanka facing the imminent threat of starvation, as Hannah Ellis-Petersen, our South Asia correspondent, reported:

Over the past few months, Sri Lanka has been facing a dire financial crisis on multiple fronts, triggered partially by the impact of Covid-19, which battered the economy, as well as mounting foreign debts, rising inflation and economic mismanagement by the government, led by President Gotabaya Rajapaksa.

The country barely has any foreign currency reserves left, leading to dangerous shortages of food, gas and medicines as it is unable to import foreign goods, while people are enduring power blackouts of up to eight hours a day. The situation has pushed thousands out onto the streets in protest in recent days, calling for the resignation of the president.

Protestors have been hit with teargas and water cannon in some instances and dozens have been arrested, but it has done nothing to prevent citizens from across all generations and walks of life turning out on the streets.

2h ago10:17

Elsewhere in the markets, the pound has dropped below $1.30 to its lowest level against the US dollar since November 2020.

Sterling is under pressure against the dollar, as America’s central bank has underlined its determination this week to tighten monetary policy to tame inflation, by unwinding its stimulus package.

2h ago09:55

Today’s interest rate cut suggests that Russia’s central bank is confident that the “most acute phase of the economic crisis has now passed” and a bank run has been avoided, says Liam Peach, Emerging Europe Economist at Capital Economics.

Peach predicts that further, gradual, rate cuts are likely over the course of this year as the CBR tries to bring inflation back to target, adding:

The decision came as a surprise as no official meeting had been scheduled until late-April (we had expected a 300bp cut in June), but the press statement pointed to two developments.

First, the central bank said that “there is a steady inflow of funds to fixed-term deposits”, which suggests that the CBR has become confident that it its emergency rate hike to 20% at the end of February, alongside capital controls and other measures, prevented a major and destabilising bank run.

The second is that the CBR said that “weekly data point to a noticeable slowdown in current price growth rates”.

3h ago09:45Joanna Partridge

UK travel news: HM Revenue and Customs (HMRC) says it has “successfully made changes” to its network, allowing traders and hauliers to use the goods vehicle movement service (GVMS), a post-Brexit customs system which has not been available for over a week.

The portal, which is used to create a goods movement reference (GMR) number needed for exporting from and importing to the UK, had been suffering an outage since last Thursday.

Even though HMRC had said hauliers could use other documentation to show that a customs declaration had been made, as part of its contingency measures, industry insiders had complained that the GVMS outage was adding to lengthy queues of HGVs trying to reach France by ferry or Eurotunnel.

Lorries queued in Operation Brock on the M20 near Ashford in Kent yesterday Photograph: Gareth Fuller/PA

Lorries queued in Operation Brock on the M20 near Ashford in Kent yesterday Photograph: Gareth Fuller/PA

Thousands of lorry drivers were caught in the gridlock, which was also partly caused by reduced sailings from Dover while P&O Ferries is out of service, plus extra Easter tourist traffic, and a backlog of freight traffic.

HMRC said:

“Contingencies will remain in place over the weekend to continue to ensure the movement of goods and allow continued testing.”

From midday on Monday, all traders will have to create a GMR – a barcode – with GVMS in order to transport their goods.

Updated at 10.14 EDT

4h ago08:15

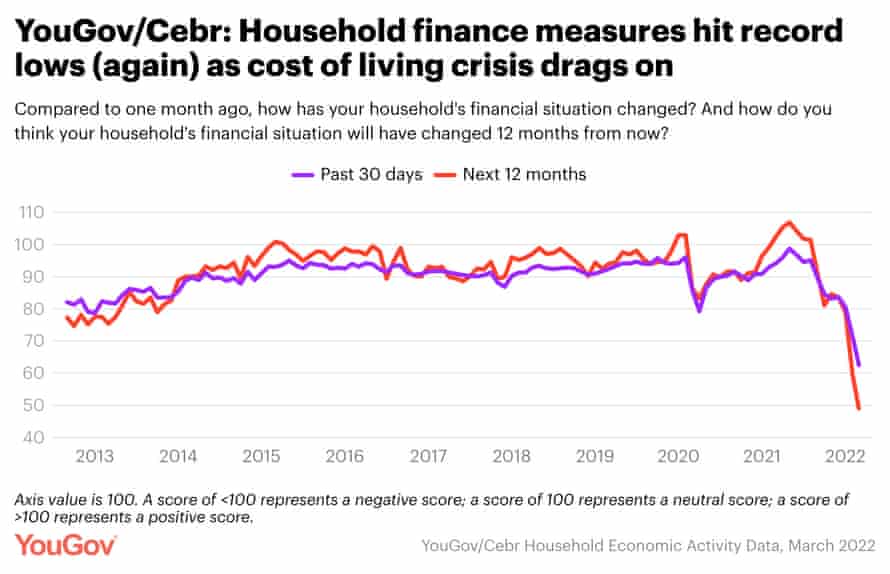

Back in the UK, the cost of living crisis means households are more worried about their personal finances than they have been in at least a decade

The latest analysis from YouGov and the Centre for Economics and Business Research show that confidence about household finances is the lowest since the survey began 10 years ago.

Households were more pessimistic about the outlook over the next year, and reported a sharp deterioration over the last month, as rising food and energy prices hit budgets.

UK household finance confidence Photograph: CEBR/YouGov

UK household finance confidence Photograph: CEBR/YouGov

Emma McInnes, Global Head of Financial Services at YouGov, says:

“The ongoing cost of living crisis and uncertainty caused by continued conflict in Ukraine has, once again, seriously impacted on both consumer confidence and the public’s household finances. For the second month running, tumbling household finance measures – both retrospective and forward-looking – find themselves at their lowest ever level since tracking began almost ten years ago.

Aside from a small uptick in job security outlook, confidence and household finance figures, combined with house price scores stagnating after four months of growth, have largely contributed to the overall consumer index continuing to fall”

5h ago07:155h ago06:57

Here’s Craig Erlam, senior market analyst at OANDA, on today’s cut to Russia’s main interest rate today:

The Bank of Russia [CRB] is seemingly buoyed by recent actions from the Kremlin despite severe sanctions continuing to be imposed by the West.

The capital controls that have been imposed have helped to shore up the rouble which appears to have given the CBR confidence that interest rates no longer need to be so high.

It cut the Key Rate by 3% and left the door open to further cuts depending on financial and economic conditions. At 17%, the rate remains extremely high as inflation is still expected to spike and the economy severely contract.

When the Ukraine war began, the rouble plunged from below 80 to the US dollar to as low as 135 roubles/$1.

But it has now recovered to near February’s pre-invasion levels, supported by capital controls including a ban on banks and brokers selling dollars, euros and other foreign currencies, and curbs on sending money abroad.

6h ago05:57

UK: Russia heading for deepest recession since Soviet Union collapsed

Russia is heading for its deepest recession since the collapse of the Soviet Union, the UK government has predicted.

Economists expect Russia’s GDP this year to contract by between 8.5% and 15%, the UK says, as it announces sanctions on Vladimir Putin’s two adult daughters.

GDP growth is likely to be depressed over the longer term, as Russia is cut off from Western technology, it adds.

Around £275bn, or 60% of Russian foreign currency reserves, are currently frozen, the UK estimates, which has hampered Moscow’s ability to support its economy.

Foreign Secretary Liz Truss said:

Our unprecedented package of sanctions is hitting the elite and their families, while degrading the Russian economy on a scale Russia hasn’t seen since the fall of the Soviet Union.

But we need to do more. Through the G7, we are working with partners to end the use of Russian energy and further hit Putin’s ability to fund his illegal and unjustified invasion of Ukraine.

Together, we are tightening the ratchet on Russia’s war machine, cutting off Putin’s sources of cash.

Last month the Institute of International Finance forecast that Russia’s economy would shrink by 15% this year, and that any further boycotts of Russian energy would drastically impair its ability to import goods and services.

Those recession concerns prompted Russia’s central bank to cut interest rates from 20% to 17% this morning.

#Russia delivers surprise rate cut by 300bps from 20% to 17% amid recession, Ruble rebound. Financial-stability risk no longer rising, Bank of Russia says. Central bank says further cuts could come at future meetings. Ruble stays below 80 per Dollar. pic.twitter.com/olaQr7FMrh

— Holger Zschaepitz (@Schuldensuehner) April 8, 2022

The foreign currency freeze stopped Russia paying holders of its sovereign debt more than $600m earlier this week. The US Treasury blocked Russia’s ability to make debt payments in dollars through American banks, meaning Moscow had to set aside roubles instead. That could count as a debt default, after a 30-day grace period.

Updated at 06.03 EDT

7h ago05:33

UK sanctions daughters of Putin, and Lavrov

The UK has added Russian president Vladimir Putin’s daughters to its sanctions list, matching a move by the United States this week.

Katerina Tikhonova and Maria Vorontsova, Putin’s two adult daughters with his former wife Lyudmila Shkrebneva, and Yekaterina Sergeyevna Vinokurova, daughter of foreign minister Sergey Lavrov, will be subject to travel bans and asset freezes.

The UK say the move will further target “the lavish lifestyles of the Kremlin’s inner circle”.

By freezing the assets and limiting the travel of Putin’s allies, the UK Government is sealing off reservoirs of cash funding the conflict, while also making sure those who have benefited from Putin’s rule feel the consequences.

New sanctions on Russia

🇪🇺 EU ban on Russian coal imports

🇪🇺 ban on Russian ships in EU ports

🇬🇧 UK sanctions Putin’s daughters

— Scott Beasley (@SkyScottBeasley) April 8, 2022

My colleague Rupert Neate wrote about Tikhonova and Vorontsova earlier this week:

Katerina Tikhonova, 35, the younger daughter, was born in Dresden in 1986 while Putin was working as a KGB spy. Tikhonova, who uses the surname of her maternal grandmother, studied at St Petersburg State University and Moscow State University and has a master’s degree in physics and mathematics.

As well as studying, Tikhonova has a passion for Japanese culture and acrobatic rock’n’roll dancing, an athletic form of boogie-woogie. In 2013 she and her dance partner came fifth in the world championships in Switzerland.

It was footage from her dance competitions, compared with pictures from the website of Moscow State University, where she works, that helped to first establish that Tikhonova was Putin’s daughter in 2015.

Putin’s elder daughter, Maria Vorontsova, 36, is a paediatric endocrinologist, studying the effects of hormones on the body.

In 2019 Vorontsova, who lives in a penthouse apartment opposite the US embassy in Moscow, gave an interview on Russian state TV revealing plans for a £500m medical venture aimed at helping to cure cancer.

Vorontsova married the Dutch businessman Jorrit Faassen, and the couple lived in the penthouse of an exclusive apartment building in Voorschoten, near the Hague. In 2014 some Dutch neighbours called for her to be expelled from the country after the downing of MH17 by pro-Russia forces over Ukraine.

Updated at 05.35 EDT